Examples of such decisions include whether to invest in the companys securities or recommend them to other investors or whether to extend trade or bank credit to the company. C using financial reports prepared by analysts to make economic decisions.

Financial Statement Analysis Principles Of Accounting Volume 1 Financial Accounting

Financial Statement Analysis Guides.

. Guide to Financial Statement Analysis 1 Income statement analysis. Financial statement analysis is the process of evaluating a companys financial information in order to make informed economic decisions. The financial statement analysis framework provides steps that can be followed in any financial statement analysis project.

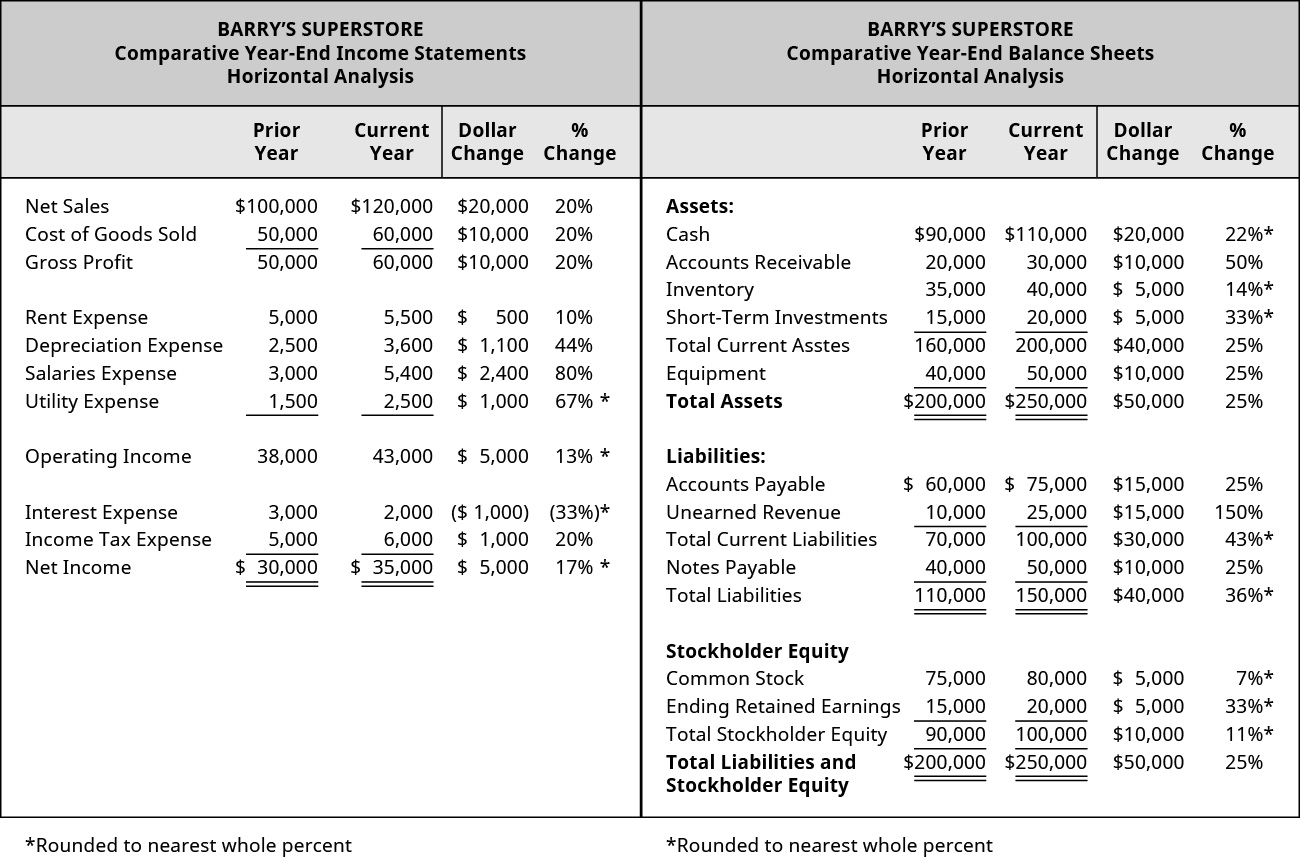

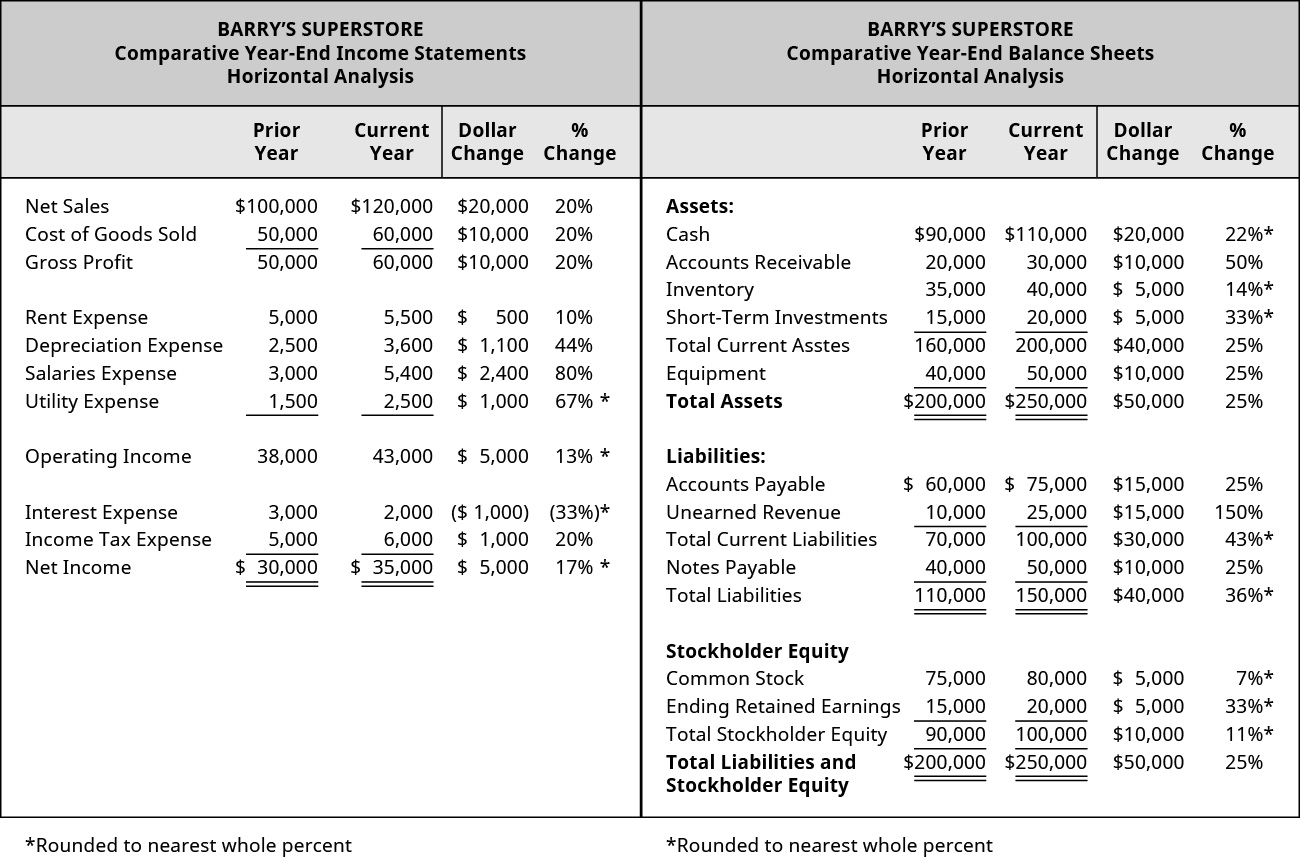

Analyzing financial statements by using financial ratios horizontal analysis and vertical analysis. The statement then deducts the cost of goods sold COGS to find gross profit. The five categories of ratios are as follows.

To calculate your debt-to-equity ratio use this formula. The following is the balance sheet for Facebook. The role of financial statement analysis is to use the information in a companys financial statements along with other relevant information to make economic decisions.

Even the smallest business can benefit from the results of financial statement analysis as a guide for the business owner. A financial statement review is a service under which the accountant obtains limited assurance that there are no material modifications that need to be made to an entitys financial statements for them to be in conformity with the applicable financial reporting framework such as GAAP or IFRS. Two types of ratio analysis are performed analysis of risk and analysis of profitability.

Balance Sheet The balance sheet is one of the three fundamental financial. The business value of a company can be assessed by looking at industry economics company strategies profitability and. Financial statement analysis consists of reformulating reported financial statement information and analyzing and adjusting for measurement errors.

Debt to Equity Ratio Total Debt Owner or Shareholders Equity. What is Financial Statement Analysis. Debt to Equity Ratio 10000 25000 04.

Financial statements show how a business operates. A review does not require the accountant to obtain. Providing information useful for making investment decisions.

Also the information listed on the income statement is mostly in relatively current dollars and so represents a reasonable degree of accuracy. Updated February 7 2021. To learn more see Explanation of Financial Ratios.

Using financial reports prepared by analysts to make economic decisions. Vertical and horizontal analysis and ratio analysis. It provides insight into how much and how a business generates revenues what the cost of doing business is how efficiently it manages its cash.

So our formula looks like this. Financial statement analysis involves gaining an understanding of an organizations financial situation by reviewing its financial reports. The results can be used to make investment and lending decisions.

There are two methods for financial statement analysis. Evaluating a company for the purpose of making economic decisions. Providing information useful for making investment decisions.

Is a combination of financial statement analysis and statistical modeling. 3 Cash flow statement. Costco has higher total assets turnover due to higher inventory receivables and fixed assets turnovers.

A providing information useful for making investment decisions. Articulate the purpose and context of the analysis. Analyzeinterpret the processed data.

Financial Statement Analysis FSA or Financial Analysis refers to the process of analysing the feasibility stability and profitability of an organization business unit or project. Financial statement analysis is the process of assessing a companys financial health by reviewing its financial statements including income statements balance sheets and cash flows. Analysis of risk typically aims at detecting the underlying credit risk of the firm.

Using the example above we include the long-term debt but not accounts payable in the calculation. Income Statement The Income Statement is one of a companys core financial statements that. Leverage liquidity efficiency profitability and debt coverage ratios.

The financial statements in the appendix are used to work through the five categories of ratios that will be discussed in detail. Practice problem 3The role of financial statement analysis is best described as. Vertical and horizontal analysis is used primarily with income statements while ratios.

The role of financial statement analysis is best described as. Using financial reports prepared by. The role of financial statement analysis is best described as.

B evaluating a company for the purpose of making economic decisions. This review involves identifying the following items for a companys financial statements over a series of reporting. 2 Balance sheet and leverage ratios.

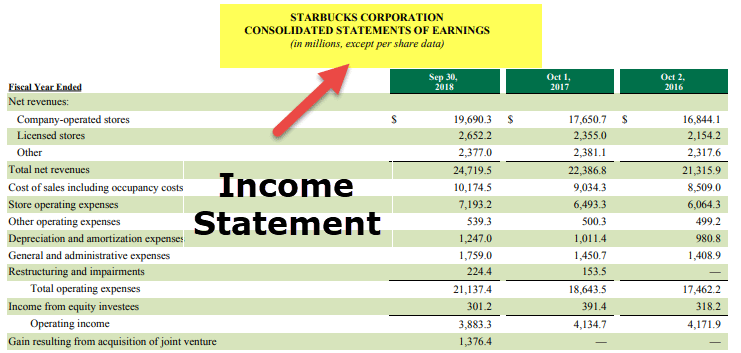

1 Income statement Often the first place an investor or analyst will look is the income statement. It identifies the financial strengths and weaknesses of an organization by establishing the relationship between the items of the balance sheet and the profit and loss account. It involves the review and analysis of income statements balance sheets cash flow statements statements of shareholders equity and any other relevant financial statements.

Income Statement The most important financial statement for the majority of users is likely to be the income statement since it reveals the ability of a business to generate a profit. Financial statement analysis is the use of analytical procedures to evaluate the financial health risks performance and future potential of a business. Develop and communicate conclusions and recommendations.

Evaluating a company for the purpose of making economic decisions. The income statement shows the performance of the business throughout each period displaying sales revenue at the very top. Which of the following statements best describes differences in asset turnover between Target and Costco.

Financial Statement Analysis Principles Of Accounting Volume 1 Financial Accounting

Financial Statements Examples Amazon Case Study

/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)

0 Comments